DAS releases first annual district by district crop growth snapshot

Technology company DAS (Digital Agricultural Services) has released its first public granular region-by-region growth snapshot for winter crop production.

Leveraging satellite technology and machine learning, DAS is providing public measurement of Net Primary Productivity, a biophysical estimate of plant growth rate that correlates well with crop yield.

It compliments wider state estimates already released by government agency ABARES forecasts.

The figures are one of DAS’ broader suite of Grain Intelligence reporting metrics, which provide granular estimates for crop area, yield, production, hay area and harvest progress, with complete flexibility on defining reporting regions or areas. The models are developed with more than 109,000 ground truth locations, including more than 13,000 locations from 2024.

“The focused, regional data we’re releasing today is just a sample of what our platform is capable of producing, ” Anthony Willmott, CEO and co-founder of DAS said.

“With climate change playing an escalating role in harvest variance and food security, many of our clients rely on our data to make decisions about harvesting and understand the market conditions for various crops at precise locations. We’ve seen this in today’s data. High variance in rainfall across Australia has essentially made some of our lowest producing areas turn out a bumper crop, and our grain powerhouses regions hit record lows in terms of expected yield.”

“More broadly, accurate crop predictions are critical for Australia, with the country consistently ranking as one of the top 10 global producers of critical commodities such as wheat, canola and barley.”

“Crop forecasting is a little predicting the weather. Thanks to advances in technology, it’s seen a massive step-change with our three and four day forecasts now as accurate as our one day forecasts were 30 years ago. In the same way, machine learning, earth observation, geospatial technology and remote sensing are today transforming the future of crop prediction for better food forecasts.”

DAS has offered data solutions covering the lifecycle of the world’s most important commodity -- grain -- for over five years. The data, powered by advances in satellite technology, have proved instrumental in decision making for a number of policy agendas including: risk mitigation, food security and trade. Financial institutions and insurance firms are also using the data to manage and mitigate risk as climate variability continues to intensify.

The company’s data is already materially changing the way grain data is used for decision-making through their technology and tools, with use cases spanning not just the grains industry but policy making, insurance and more.

“Clients today say we are the country’s largest forecaster using machine learning methods supplemented by ground truthing. Not only are we a world-leader in this space, but the models we have developed are globally significant in that they are created and implemented for highly variable climates,” Willmott said.

Top 10 cropping regions by change in NPP:

|

RANK |

LGA |

Net Primary Productivity (NPP) |

NPP 10 Year Avg |

Percentage above average |

|

1 |

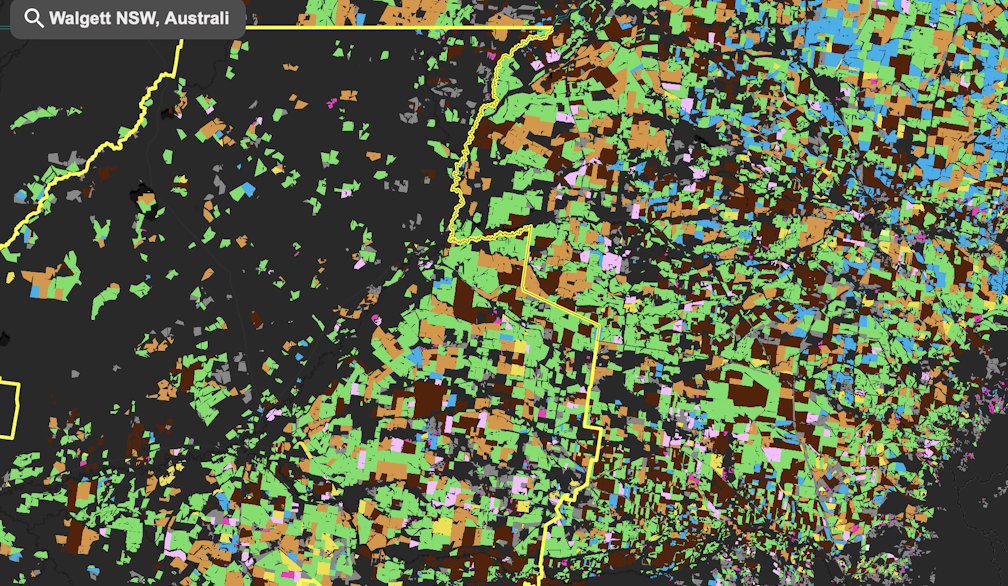

Walgett, NSW |

2.26 |

0.99 |

103% |

|

2 |

Moree Plains, NSW |

2.66 |

1.48 |

79% |

|

3 |

Balonne, QLD |

0.99 |

0.53 |

79% |

|

4 |

Coonamble, NSW |

2.55 |

1.53 |

66% |

|

5 |

Tamworth Regional, NSW |

1.38 |

0.83 |

66% |

|

6 |

Liverpool Plains, NSW |

1.78 |

1.07 |

66% |

|

7 |

Inverell, NSW |

1.14 |

0.71 |

61% |

|

8 |

Brewarrina, NSW |

0.90 |

0.59 |

53% |

|

9 |

Mount Marshall, WA |

1.67 |

1.30 |

29% |

|

10 |

Narembeen, WA |

3.70 |

3.05 |

21% |

*Data captured by DAS on September 12.

Lowest 10 cropping regions by change in NPP:

|

RANK |

LGA |

Net Primary Productivity (NPP) |

NPP 10 Year Avg |

Growth |

|

1 |

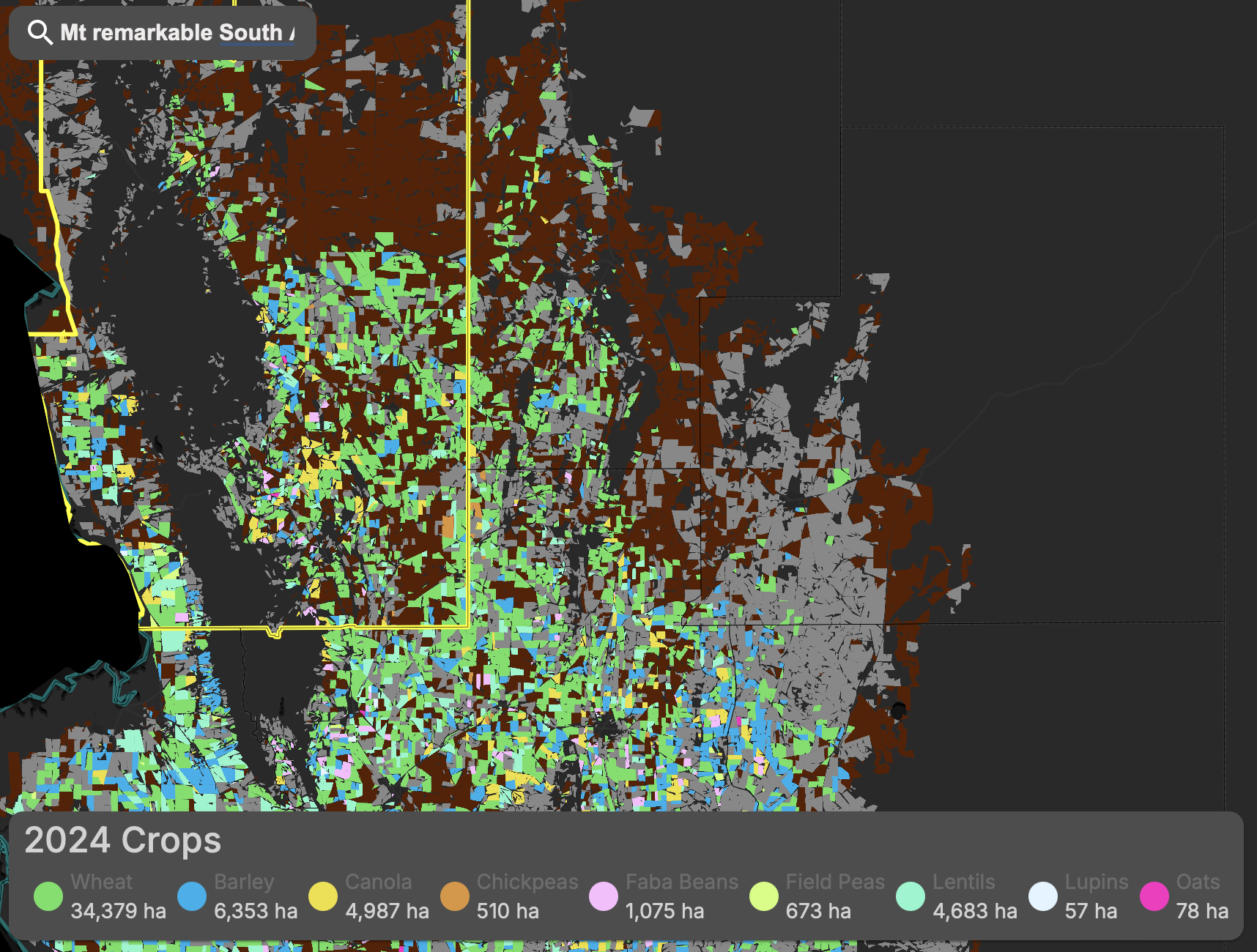

Mount Remarkable, SA |

1.27 |

2.56 |

-50% |

|

2 |

Streaky Bay, SA |

1.37 |

2.77 |

-50% |

|

3 |

Murray Bridge, SA |

0.98 |

1.90 |

-48% |

|

4 |

Ceduna, SA |

1.09 |

2.09 |

-46% |

|

5 |

Port Pirie, SA |

2.16 |

3.33 |

-35% |

|

6 |

Greater Geelong |

1.48 |

2.29 |

-35% |

|

7 |

Franklin Harbour, SA |

1.14 |

1.64 |

-31% |

|

8 |

Wudinna, SA |

1.85 |

2.64 |

-30% |

|

9 |

Goyder, SA |

1.10 |

1.54 |

-28% |

|

10 |

Wakefield, SA |

3.16 |

4.12 |

-23% |

*Data captured by DAS on September 12.

Analysis:

Anthony Willmott, CEO and co-founder of DAS said: “This data illustrates how variable crop conditions can be between seasons and across the country. On the back of well timed and above average rainfall in Northern NSW LGAs such as Walgett and Moree Plains are having their best seasons since 2010. Meanwhile most parts of SA are looking similar (in terms of NPP) to the drought year of 2017.

“While ABARES data is forecasting a 9% decrease in winter crop production in South Australia, our data does not leave us that optimistic. It provides further context to some of the hardship farms may face this season due to drought.”

About DAS

DAS is a technology company that delivers location intelligence for financial services and enterprises, with a unified system of data, insights, software and CRM integrations. A product-focused fintech, DAS is accelerating innovation across the entire agri-enterprise ecosystem. Decision-makers use DAS’ unique ecosystem of products and tools to get the multi-dimensional intelligence they need to lend, insure, invest and sell better in a dynamic climate.

Five years ago, DAS pioneered its vision for the Rural Intelligence PlatformTM, transforming how decisions are made in the businesses surrounding agriculture for a safer, more resilient, more prosperous, more sustainable world. Today, DAS’ platform has evolved to meet an acute area of need for financial services and agri-enterprise, with 140+ customers including Rabobank, IAG, Australian Bureau of Statistics (ABS), Nutrien, Cargill, Viterra, Rabobank and IAG. Integrating location intelligence, climate, productivity, sustainability, risk and carbon data, it offers the multi-dimensional intelligence they need to lend, insure, invest and sell better.